Use your “emergency fund” to cover maintenance and repairs.Choose an amount to set aside every month toward a maintenance “fund”.Do the best you can to estimate a monthly cost.If you’re not sure what to enter in the budget calculator, here are 3 ways to approach the problem: You can go months without incurring any repair and then have to replace your entire roof, so try to put together a rough estimate - it’s always better to overestimate and be prepared. If you’re a homeowner or renter who is responsible for maintenance and repairs, you’ll want to try and estimate what you spend per month - which can be difficult.

Unless you have a specific agreement with your landlord to fix things around your rental property, you can leave this section blank. Repairs/Maintenance: If you rent, your landlord is most likely the party responsible for any repairs around the house. If your home insurance is wrapped up in your monthly mortgage payment, don’t worry about it adding in this section - you don’t need to account for the payment twice. Home insurance: This box is for home insurance or renter’s insurance. You can also use this box for other home-related expenses like storage rental fees, monthly pet fees, parking fees, or any costs that aren’t otherwise covered in this section of the budget maker.

#RETIREMENT LIVING EXPENSES CALCULATOR FULL#

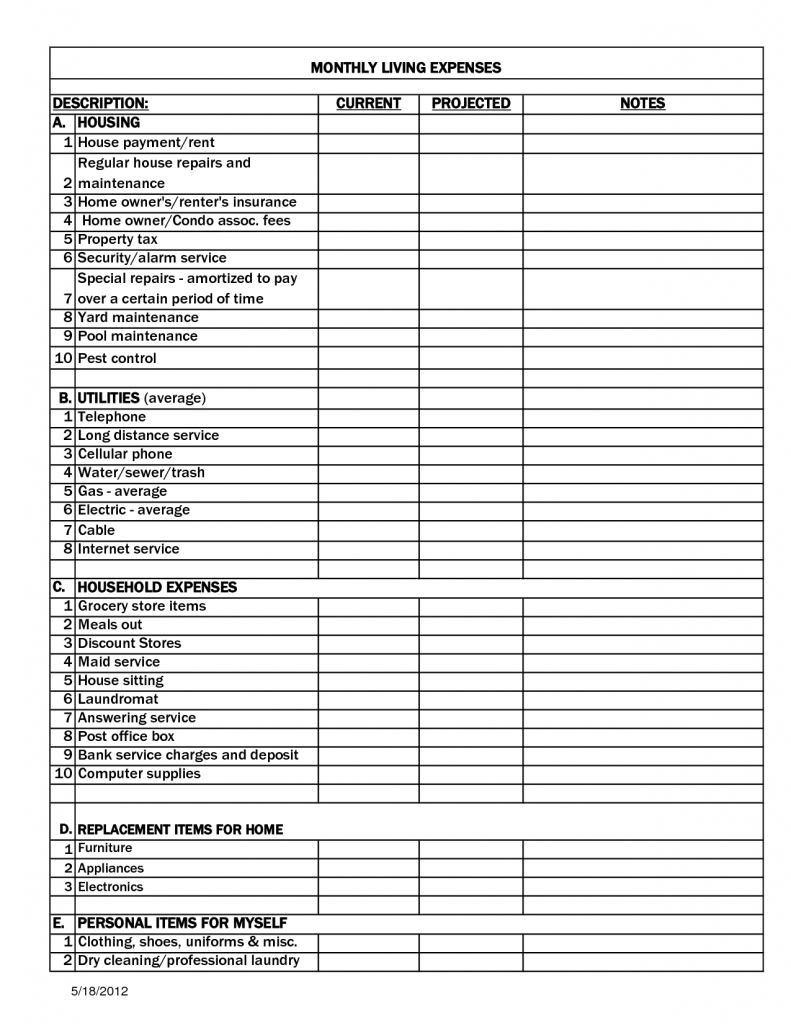

Have a yard full of pink plastic flamingos because you’ll never answer to a HOA? Leave the box blank. HOA Fees: If your neighborhood has a HOA, you need to make sure you account for your fees in the budget calculator. If you own your home and your property taxes are not included in your mortgage payment, divide those taxes by 12 and add it to your mortgage - the goal is to ensure that your property taxes are covered in your monthly budget. Enter the amount of your monthly mortgage payment in the mortgage box, or the amount of your monthly rent in the rent box of the budget calculator. Mortgage or Rent: Whether you own or rent, you’ll need to factor in your housing expenses. Others, like groceries and entertainment expenses, will be estimates. Some of these costs, like rent and car payments, will be specific numbers. Once you’ve figured out how much money you’re bringing in each month after taxes, you’ll need to figure out how much you need to spend on your monthly expenses.

#RETIREMENT LIVING EXPENSES CALCULATOR HOW TO#

Step 2: How to determine and enter monthly expenses You can also use this section to add a second income if you’d like to create a joint budget. If you have additional income such as a side hustle, or you receive child support, alimony, or other supplemental income, add that monthly amount under Other Income. If the last 3 months were unusually high or low, add up all your deposits for the past year instead and divide by 12 to get a better average. Enter that amount in the budget calculator. If your income changes from month to month, add up your total monthly deposits for the last 3 months and divide that number by 3 to get a baseline monthly estimate.If you get paid every other week, multiply your take-home amount by 26 for the number of checks you get each year, and then divide by 12 to get your monthly take-home pay.If you get paid twice a month, add the take-home amount of your two checks together and enter that amount.If you get paid a regular check once a month, enter your net income after deductions each paycheck.To determine what to enter under Salary/Wages in the budget calculator, follow these steps: Remember, this is the amount you can spend every month, so be sure to use your net income - which is the money you’re left with after taxes and deductions for things like health insurance and your 401(k), not your gross income, which is your total pay before any deductions.

Ready to get started? To use our monthly budget calculator, first you need to figure out your monthly income. Build your budget in 3 easy steps Step 1: How to figure out your monthly income

0 kommentar(er)

0 kommentar(er)